消费级的AI现在与未来 State of Consumer AI 2025: Product Hits, Misses, and What’s Next

2025年AI消费市场呈现"赢家占优"格局:ChatGPT保持领先优势(8-9亿周活用户),但Gemini增速迅猛(付费用户年增300%)。OpenAI通过现有界面整合新功能,Google则采取多产品并行策略,NotebookLM成为亮点。其他玩家中,Anthropic专注专业用户,Perplexity深耕生产力工具,xAI的Grok实现快速能力迭代,MetaAI在争议中增长。

https://a16z.com/state-of-consumer-ai-2025-product-hits-misses-and-whats-next/

It was a big year for consumer launches from the major AI labs. OpenAI shipped dozens of AI features – including GPT-4o Image, the standalone Sora app, and group chats. Gemini released several insanely viral image and video generation models (Nano Banana and Veo). Other labs like Anthropic, Perplexity, xAI, and Meta all released new consumer-facing tools across things like chat, coding, search, image generation, and more. The result? Somewhat of a mixed bag.

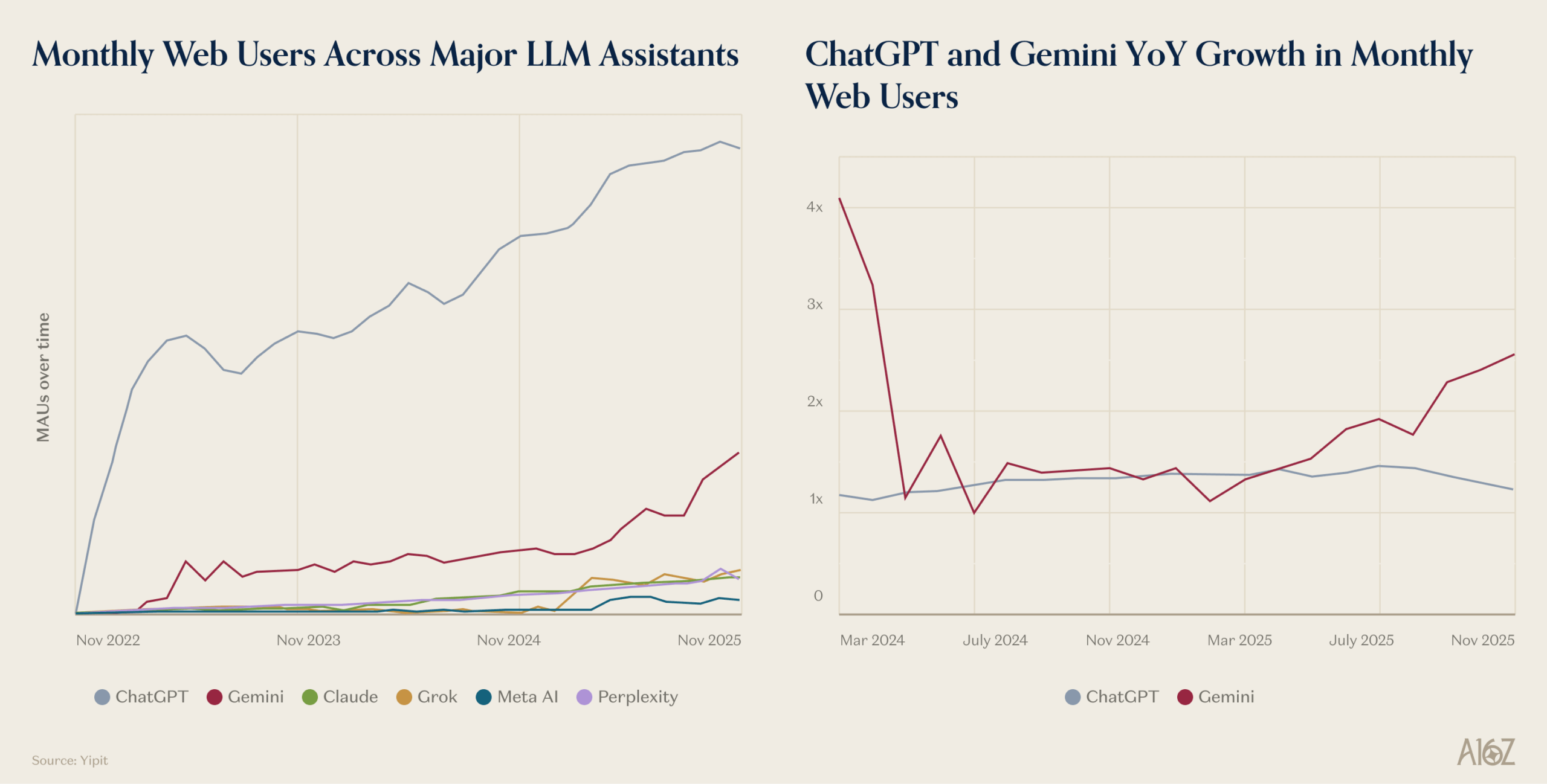

Overall, AI usage is up. But when it comes to a general assistant, the vast majority of consumers are still using only one. For most of the year, fewer than 10% of ChatGPT weekly users even visited another one of the big model providers. And data from Yipit suggests that spend is equally concentrated – only 9% of consumers pay for more than one subscription across ChatGPT, Gemini, Claude, and Cursor. While the LLM assistant race may not be “winner take all,” it’s looking like it might be “winner take most.”

After becoming the fastest product to ever hit 100M WAUs (in 2023), ChatGPT has sustained massive consumer adoption with an estimated 800 – 900M WAUs across platforms. Gemini is at 34% of ChatGPT’s scale on web, and 40% on mobile. ChatGPT is also dominant when it comes to engagement and retention. Per Yipit, ChatGPT’s DAU/MAU of 36% is nearly double Gemini’s 21%. And, month 12 desktop user retention of 50% is similarly double Gemini’s 25%.

However, in recent months Google has fired up the engines and Gemini is seeing the results. Per Yipit, ChatGPT is growing desktop users 23% YoY vs. Gemini at 155% YoY. And Gemini’s growth rate has actually accelerated (even on a larger user base) in each of the last five months – new image models like Nano Banana are a big driver here.

Another bright spot for Gemini? Paid users. Gemini is growing Pro subscriptions nearly 300% YoY, compared to 155% for ChatGPT. And, while ChatGPT’s free user retention is substantially better than Gemini’s, paid users are showing retention in the same ballpark – at 68% by month 12 for ChatGPT, and 57% for Gemini measured on the most recent cohorts.

Separate from what the data said – who won consumer mindshare this year? We broke down the biggest developments of the year, as well as where we expect the model companies are headed in 2026.

对各大AI实验室而言,这是消费级产品密集发布的一年。OpenAI推出了数十项AI功能——包括GPT-4o图像识别、独立版Sora应用和群组聊天功能;Gemini发布了多款引发病毒式传播的图像视频生成模型(如Nano Banana和Veo);Anthropic、Perplexity、xAI和Meta等其他实验室也相继发布了涵盖聊天、编程、搜索、图像生成等领域的消费级工具。但结果如何?可谓喜忧参半。

总体来看,AI使用率正在上升。但在通用助手领域,绝大多数消费者仍只使用单一产品。全年大部分时间里,每周使用ChatGPT的用户中仅有不到10%会访问其他主流模型提供商。Yipit数据显示消费集中度同样惊人——在ChatGPT、Gemini、Claude和Cursor的付费用户中,仅9%会同时订阅多个服务。虽然大语言模型助手竞赛未必是"赢家通吃",但"赢家占优"的格局已现端倪。

ChatGPT在成为史上最快达成1亿周活产品(2023年)后持续扩张,目前跨平台周活用户估计达8-9亿。Gemini的网页端规模为ChatGPT的34%,移动端为40%。在用户粘性方面,ChatGPT同样占据优势:Yipit数据显示其日活/月活比达36%,近乎Gemini(21%)的两倍;桌面端12个月用户留存率50%,同样是Gemini(25%)的两倍。

但近几个月谷歌开始发力,Gemini成效显著。据Yipit统计,ChatGPT桌面用户年增长率23%,而Gemini高达155%。值得注意的是,Gemini在用户基数扩大的情况下,过去五个月增速持续提升——Nano Banana等新型图像模型是重要推动力。

Gemini的另一亮点在于付费用户。其Pro订阅量年增长近300%,远超ChatGPT的155%。虽然ChatGPT免费用户留存率显著领先,但两者付费用户留存率已趋接近:最新队列数据显示,ChatGPT第12个月留存率为68%,Gemini为57%。

抛开数据不谈,今年谁赢得了消费者心智?我们梳理了年度重大进展,并预测2026年模型公司的竞争格局。

OpenAI

ChatGPT came into the year as by far the dominant player. They had the first big viral launch of the year with 4o-image generation in March (remember the mass Ghibli event?), adding 1M users per hour at the peak. OpenAI’s consumer strategy for the year was pushing new models and experiences through the existing ChatGPT interface.

Some examples? Pulse (daily updates), Group Chats, Record (transcriber), Shopping Research, Tasks, and Study Mode are all new experiences, while Agent and Personalities are enhancements to normal ChatGPT usage. We would argue that none of the new experiences have truly “broken through” in terms of either usage or retention. It’s hard to deliver a first class product experience within the constraints of the existing ChatGPT interface.

ChatGPT is also doubling down on becoming a place for individuals to manage their work. This year saw the launch of Connectors, where you can give ChatGPT access to a variety of work apps (e.g. the G Suite, Microsoft, Notion, Stripe, Slack) so it can pull context and push actions. And ChatGPT’s own Agent can hypothetically help generate presentations and analyses, though in our experimentation so far it’s been somewhat slow and buggy.

There are two big exceptions here when it comes to new interfaces. The first is Sora, which got a standalone app this year. It has been very successful as a creative tool, with more than 12M global downloads. It’s less successful as a social app, with SensorTower estimating retention sub-8% at day 30. D30 retention is above 30% for top consumer apps.

The second product expansion for ChatGPT was Atlas, the company’s browser. ChatGPT was a bit late to the game, coming out with Atlas after Perplexity’s Comet and The Browser Company’s Dia – but it’s a powerful and well-executed product. Atlas is still available only on Mac, and Yipit estimates under 5% of ChatGPT users have visited the Atlas download page, so usage is likely still fairly minimal.

Next year, we’re looking towards where they take Apps, the company’s new infrastructure for allowing third party developers to build experiences in ChatGPT. ChatGPT has a chance to become the first true new consumer platform in more than a decade if this is successful. But, they will fight against the same forces as with Connectors in terms of providing enough space to power magical consumer experiences.

Google has come a long way since the days of Bard. The company had a massive 2025 in both new models and new products. Unlike OpenAI, Google creates more surface area for new products – the company launches models within Gemini and other access points (e.g. AI Studio, Labs, Flow), but will also create standalone experiences.

On the model front, Google won the consumer zeitgeist with Nano Banana and Nano Banana Pro. Per Google VP Josh Woodward, in the first week Nano Banana saw 200M images generated and brought in 10M new users in Gemini. While slightly less viral in terms of sheer usage, Google’s Veo 3 video model was arguably the breakthrough moment for AI video in combining visual and audio generation.

On the product front, NotebookLM may be the best example of Google launching successful new interfaces. NotebookLM initially went viral in September 2024 – and usage is still growing. Web users more than doubled YoY as of November. And the mobile app, which launched in May, now has 8M MAUs. That product also continues to evolve, with updates like slide generation, video overviews, and infographics.

Google has released many other products this year that have seen relatively muted traction – Portraits, Doppl, Whisk, Gems, among many others. But, in contrast to OpenAI’s approach of “shoving” everything into ChatGPT, these launches are not cluttering the core Gemini experience. They can sink or swim (as NotebookLM has!) on their own. The most significant area for improvement here is actually access – it’s confusing to figure out where to access new products, and what kind of account you need to do so.

Google has made some strides in embedding AI into its core products, though progress has been slower here. Gemini is now available in the Chrome browser to interact directly with pages. Other significant launches include “help me write” and “help me schedule” in Gmail, and “take notes for me” and real-time speech translation in Google Meets. The existing Google Suite has a significant distribution advantage, though it feels like the AI-native version of each of these products may be a more powerful experience.

Google has had some of the biggest moments on the model front, Gemini is picking up steam, and NotebookLM continues to be an extremely bright spot in terms of mainstream consumer AI usage. With that being said, there was real missed opportunity by not making their products more accessible.

Next year, we’re looking towards whether they bring AI into more of the core experience, as ChatGPT continues to erode Search. AI Mode debuted in Google Search in May, though per Yipit only about 2% of weekly users are interacting with it. Google recently demoed Disco, which will remix your search tabs into interactive, custom web apps – which feels like the “biggest swing” we’ve seen from Google perhaps ever in innovating on their core UI.

Other Players

We would be remiss not to mention what some of the other core players have done in consumer AI this year.

Anthropic

Anthropic remains very focused on the “prosumer” user – and within that, the technical user. Almost all of their consumer-facing launches were within Claude or extending Claude (Claude for Chrome, Claude Desktop).

They launched some very powerful new primitives for doing work – Skills and Artifacts are the most notable, which feel geared towards more sophisticated users. Anthropic was also the first of the big labs to launch a dedicated effort towards generating slides, documents, and models – and, in our testing, their product is much faster and more reliable than ChatGPT’s Agent.

Claude also finally caught up on a few core features that ChatGPT has had for a while, including Voice Mode, Memory, Web Search, and Research (their version of Deep Research). However, this feels more about re-establishing “table stakes” than trying to attract a new audience or user.

Next year, we expect to see Anthropic to continue to invest in Claude Code, which reached a $1B run rate in six months. We would expect to see other launches tailored towards the same type of user – perhaps a first-class data analysis interface, or something adjacent.

Perplexity

Perplexity similarly doubled down on the prosumer user this year, but with a focus on the less technical “productivity hacker.” Their biggest launches were Comet (arguably the first true AI browser), and Email Assistant. While neither product has gone mainstream viral, Comet has more than a million users and is still our favorite AI browser.

Perplexity also continues to innovate in shopping, after first launching an AI-powered shopping assistant at the end of last year. This year, they launched a new conversational commerce agent and a virtual try-on tool that converts a photo to a digital avatar.

The company announced a $100M run rate in March this year, with 6x YoY growth in paid usage, and more than 20M monthly active users. Perplexity’s acquisitions may hint towards where they dedicate resources next year – they purchased Read.cv (LinkedIn competitor), Visual Electric (prosumer creative tools), Invisible (agent infrastructure), and Carbon (external data source -> LLM connector).

xAI

Grok has come a long way this year. In January, xAI launched Grok as a standalone app – before, it was only available as a chatbot on X. In July, xAI made waves with the launch of Companions (initially Ani and Rudi). Until that point, most AI companions were just voices – Grok changed the game with fully animated characters and more controversial personalities.

In August, xAI shipped its own image and video models in Grok Imagine. And they regularly release updated models with new capabilities – Grok now has text-to-video and image-to-video models with sound (including voice with lip sync). This may be the fastest ramp we’ve seen in terms of capability improvements.

According to SensorTower data, Grok went from zero users at the beginning of this year to 9.5M DAU and 38M MAU as of mid-December. Grok has also gotten more integrated into the X app – you can now “long click” on any image on your timeline to edit it or make a video with Grok.

We expect more to come next year, particularly when it comes to longer form or more interactive content. Elon publicly announced that we should expect to see a “watchable” movie and a “great” AI-generated game from Grok before the end of 2026. And we’ll likely see Grok play an even bigger role in the X app – Elon has stated that the algorithm will be controlled by the model reading and watching content to “match” users with posts that should interest them.

Meta

It’s been a rockier year for Meta. The company launched a standalone app called Meta AI in April – intended as a place to chat with your AI assistant. But the app went viral in June when people discovered that older users were accidentally sharing their conversations with the chatbot on the main Discover feed. The app re-launched in September with “Vibes,” a scrolling feed of short form AI-generated videos, after Meta inked a partnership with Midjourney.

The vibes (pun intended) haven’t been amazing – but the Meta AI app has shown consistent growth, primarily outside the U.S. It’s now at 4.2M DAU and 26.6M MAU as of mid-December, according to SensorTower.

Meta notoriously poached an all-star research team this year, and they have a massive distribution advantage across their existing apps (Facebook, Instagram, and WhatsApp). We’re starting to see them integrate models into these products – like the AI translation in Instagram Reels – and we’re looking forward to seeing what the next year has in store.

Where do startups fit in?

Despite all this activity from the model giants, we’ve never been more excited about what startups can build in consumer AI. It’s clear now where the big labs are putting their attention – (1) on the models themselves – which only benefits application layer companies; and (2) on new features and interfaces largely delivered via their existing products.

This leaves huge white space for founders who are building dedicated consumer experiences. Model companies don’t have the intuition or, quite frankly, the attention and resources to be innovating outside their areas of core competency. Consumer founders may even be able to benefit from ChatGPT’s upcoming push on discovery and distribution for third-party apps.

We’ve already seen many examples here – consumer AI products that have “broken out” and reached millions of consumer users (and grown revenue faster than ever before) include Replit, Gamma, Character AI, Suno, Eleven Labs, Manus, Krea, Lovable. These products all have opinionated and focused interfaces that give consumers superpowers beyond what the model companies offer themselves.

初创企业该何去何从? 尽管模型巨头们动作频频,我们对初创企业在消费级AI领域的创新潜力却比以往更加期待。如今大实验室的聚焦方向已十分明确——(1)专注模型本身(这反而利好应用层企业);(2)主要通过现有产品提供新功能和界面。

这为打造专属消费体验的创业者留下了广阔天地。模型公司既缺乏直觉,坦白说也无暇在核心优势领域外投入创新资源。消费领域的创业者甚至可能受益于ChatGPT即将推出的第三方应用发现与分发功能。

已有诸多成功案例涌现——突破重围、收获数百万用户(且营收增速创纪录)的消费级AI产品包括Replit、Gamma、Character AI、Suno、Eleven Labs、Manus、Krea、Lovable。这些产品均具备鲜明特色的专注型界面,赋予用户模型公司自身产品无法提供的超级能力。

https://a16z.com/state-of-consumer-ai-2025-product-hits-misses-and-whats-next/

更多推荐

已为社区贡献53条内容

已为社区贡献53条内容

所有评论(0)