聚宽策略研究--3小市值无卖出缓冲池

这是一个相对成熟的多因子选股策略,结合了价值投资(基本面)和技术分析(涨停板),在小市值因子的基础上增加了严格的风险控制。排除涨停股(价格超过前收97%)和跌停股(价格低于前收104%)not_buy_again_list:30天内持有过的股票。排除ST、停牌、次新股(上市不足250天)1. 选股逻辑(my_Trader函数)如果涨停板打开(现价<涨停价),立即卖出。just_sold:近期涨停卖

策略来自聚宽社区,单纯的学习使用研究,不做投资参考,商业用途

策略原理

这是一个基于小市值+PEG估值+涨停板策略的量化交易策略。让我详细分析其核心原理:

策略核心逻辑

1. 选股逻辑(my_Trader函数)

三层筛选机制:

第一层:基础过滤

-

排除科创板、北交所股票(高风险)

-

排除ST、停牌、次新股(上市不足250天)

-

排除涨停股(价格超过前收97%)和跌停股(价格低于前收104%)

-

排除高价股(股价>10元)

第二层:基本面筛选

-

ROE > 15%(盈利能力强)

-

ROA > 10%(资产使用效率高)

-

按市值从小到大排序(小市值因子)

第三层:涨停板策略过滤

-

排除最近30天内涨停过的股票

-

排除近期持有过的股票(避免重复交易)

2. 独特的涨停板处理机制

实时监控(check_limit_up函数):

-

每天14:00检查昨日涨停的持仓股

-

如果涨停板打开(现价<涨停价),立即卖出

-

涨停板维持则继续持有

防追高机制:

-

将涨停卖出的股票加入just_sold名单

-

一段时间内不再买入这些股票

3. 风控体系

持仓管理:

-

固定持有10只股票

-

等权重分配资金

-

每月末调仓一次

交易限制:

-

4月份强制清仓(规避财报风险)

-

设置涨跌幅限制过滤

-

控制单只股票最大仓位

4. 策略优势分析

小市值效应:

-

历史证明小市值股票长期跑赢大盘

-

市值排序确保选中真正的小盘股

质量筛选:

-

ROE和ROA双重保障选股质量

-

避免陷入价值陷阱

涨停板策略:

-

捕捉短期动量效应

-

及时止盈,锁定涨停收益

5. 风险控制特色

黑名单机制:

-

not_buy_again_list:30天内持有过的股票

-

just_sold:近期涨停卖出的股票

-

有效避免反复交易同一支股票

技术面过滤:

-

排除涨停股防止追高

-

排除跌停股规避风险

-

价格过滤控制买入成本

6. 潜在改进点

当前策略可能的问题:

-

4月份清仓规则较绝对,可能错过机会

-

固定10只股票可能过于刚性

-

小市值因子在特定市场环境下可能失效

-

缺乏止损机制

建议优化方向:

-

动态调整持仓数量

-

增加市场状态判断

-

优化涨停板卖出时机

-

加入动量或波动率因子

这是一个相对成熟的多因子选股策略,结合了价值投资(基本面)和技术分析(涨停板),在小市值因子的基础上增加了严格的风险控制。

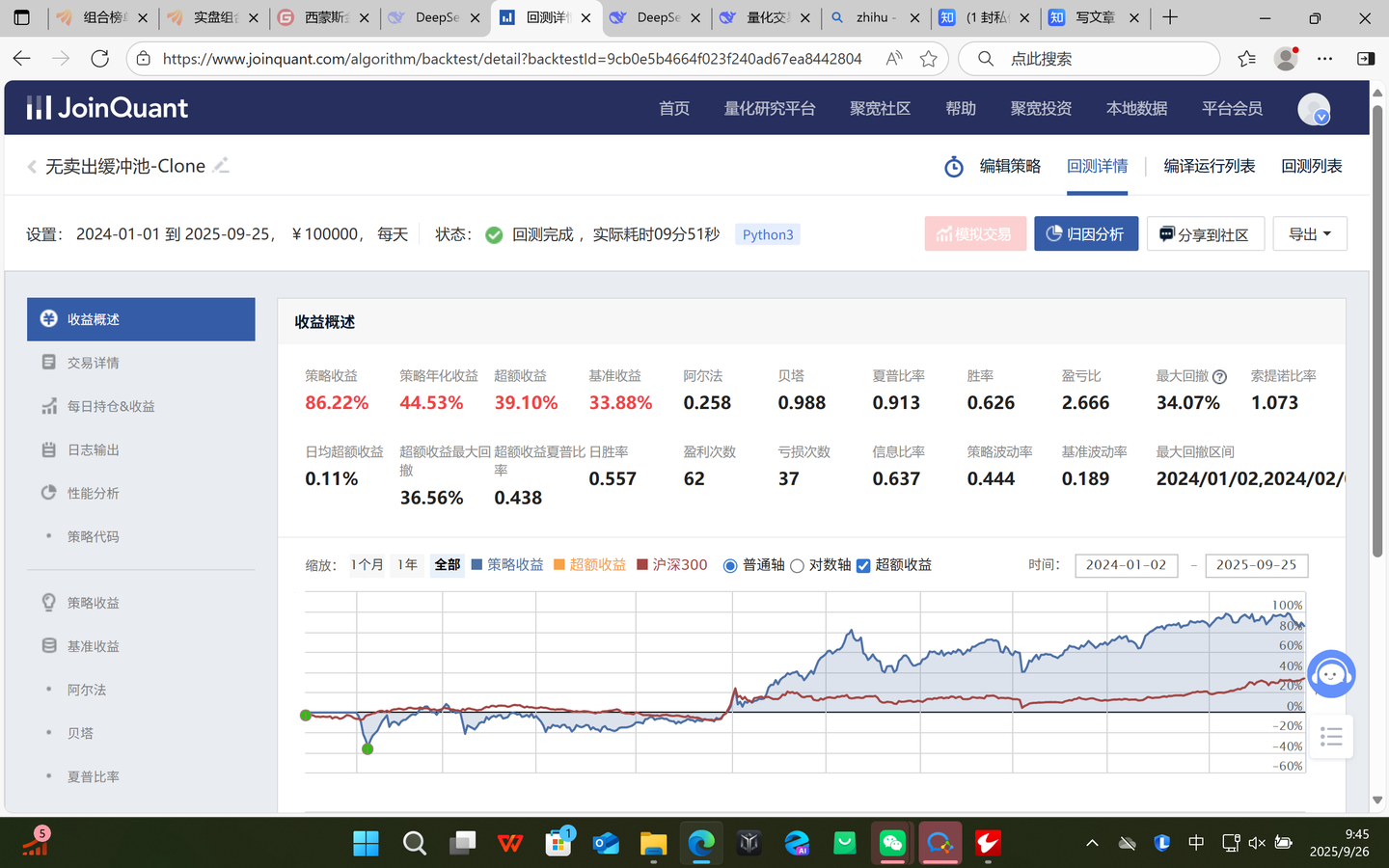

回测的数据结果

源代码

import pandas as pd

from jqdata import *

from jqfactor import get_factor_values

import redis

import json

def initialize(context):

# setting

# 设置日志级别为error

log.set_level('order', 'error')

# 开启动态复权模式(真实价格)

set_option('use_real_price', True)

# 设置是否开启避免未来数据模式

set_option('avoid_future_data', True)

# 设置基准

set_benchmark('000300.XSHG')

# 设置滑点

set_slippage(FixedSlippage(0.02))

# 设置交易成本

set_order_cost(OrderCost(open_tax=0, close_tax=0.001, open_commission=0.0003, close_commission=0.0003, close_today_commission=0, min_commission=5),type='fund')

# strategy

#初始化全局变量

g.no_trading_today_signal = False

g.stock_num = 10 # 持股数量

g.choice = [] # 股票池

g.just_sold = [] # just_sold标记本月涨停过的

g.limit_days = 30 # 限制天数N天

g.hold_list = [] # 已持有股票列表

g.history_hold_list = [] # 存放N天持有过的股票,二维数组

g.not_buy_again_list = [] # N天买过的股票,不再买入的黑名单,一维数组

# 准备昨日涨停且正在持有的股票列表

run_daily(prepare_high_limit_list, time='9:05', reference_security='000300.XSHG')

# 每天调整昨日涨停股票

run_daily(check_limit_up, time='14:00')

# 每月选股

run_monthly(my_Trader, -1 ,time='9:30', force=True)

# 每月调仓一次

run_monthly(go_Trader, -1 ,time='14:55', force=True)

# 是否是4月份,是则清仓

run_daily(close_account, '14:30')

# 收盘后运行

# run_daily(after_market_close, time='after_close', reference_security='000300.XSHG')

# 每月选股

def my_Trader(context):

#1 all stocks

dt_last = context.previous_date

stocks = get_all_securities('stock', dt_last).index.tolist()

stocks = filter_kcbj_stock(stocks)

#2 股息率筛选排序

# stocks = get_dividend_ratio_filter_list(context, stocks, False, 0, 0.25)

# stocks = get_factor_filter_list(context, stocks, 'ROAEBITTTM', False, 0, 0.2)

#4 各种过滤

choice = filter_st_stock(stocks)

choice = filter_paused_stock(choice)

choice = filter_new_stock(context, choice)

choice = filter_limitup_stock(context,choice)

choice = filter_limitdown_stock(context,choice)

#5 低价股

choice = filter_highprice_stock(context,choice)

#3 基本面筛选,并根据小市值排序

choice = get_peg(context,choice)

#过滤最近买过且涨停过的股票

recent_limit_up_list = get_recent_limit_up_stock(context, choice, g.limit_days)

# black_list = list((set(g.not_buy_again_list).intersection(set(recent_limit_up_list))).union(set(g.just_sold)))

black_list = list(set(g.not_buy_again_list).intersection(set(recent_limit_up_list)))

target_list = [stock for stock in choice if stock not in black_list]

log.info('过滤完黑名单的数量', len(target_list))

#截取不超过最大持仓数的股票量

choice = target_list[:min(g.stock_num, len(target_list))]

g.choice = choice[:g.stock_num]

#1-1 选股模块

def get_factor_filter_list(context,stock_list,jqfactor,sort,p1,p2):

yesterday = context.previous_date

score_list = get_factor_values(stock_list, jqfactor, end_date=yesterday, count=1)[jqfactor].iloc[0].tolist()

df = pd.DataFrame(columns=['code','score'])

df['code'] = stock_list

df['score'] = score_list

df = df.dropna()

df.sort_values(by='score', ascending=sort, inplace=True)

filter_list = list(df.code)[int(p1*len(df)):int(p2*len(df))]

return filter_list

# 每月调仓一次

def go_Trader(context):

if g.no_trading_today_signal == False:

# g.just_sold = [] #每月清零一次 g.just_sold 防止其中内容一直膨胀

cdata = get_current_data()

choice = g.choice

# Sell,仍在选出的股票池中,则不卖

for s in context.portfolio.positions:

if (s not in choice and (not cdata[s].paused)) :

log.info('Sell', s, cdata[s].name)

order_target(s, 0)

g.just_sold.append(s)

if len(g.just_sold) >= g.limit_days:

g.just_sold = g.just_sold[-g.stock_num:]

# buy,根据资金买入相应的金额

position_count = len(context.portfolio.positions)

if g.stock_num > position_count:

psize = context.portfolio.available_cash/(g.stock_num - position_count)

for s in choice:

if s not in context.portfolio.positions:

log.info('buy', s, cdata[s].name)

order = order_value(s, psize)

if len(context.portfolio.positions) == g.stock_num:

break

# 没用到此函数

def cap(context):

current_data = get_current_data() #获取日期

hold_stocks = context.portfolio.positions.keys()

for s in hold_stocks:

q = query(valuation).filter(valuation.code == s)

df = get_fundamentals(q)

# log.info(s,current_data[s].name,'流值',df['circulating_market_cap'][0],'亿')

log.info(s,current_data[s].name,'市值',df['market_cap'][0],'亿')

log.info(s,current_data[s].name,'股价',current_data[s].last_price,'元')

#2-3 获取最近N个交易日内有涨停的股票

def get_recent_limit_up_stock(context, stock_list, recent_days):

stat_date = context.previous_date

new_list = []

for stock in stock_list:

df = get_price(stock, end_date=stat_date, frequency='daily', fields=['close','high_limit'], count=recent_days, panel=False, fill_paused=False)

df = df[df['close'] == df['high_limit']]

if len(df) > 0:

new_list.append(stock)

return new_list

# 基本面筛选,并根据小市值排序

def get_peg(context,stocks):

# 获取基本面数据

q = query(valuation.code,

valuation.pe_ratio,

indicator.inc_net_profit_year_on_year,

valuation.pe_ratio / indicator.inc_net_profit_year_on_year,# PEG

indicator.roe / valuation.pb_ratio, # 收益率指标:ROE/PB特别适合于周期类、成长性一般企业的估值分析

indicator.roe,

indicator.roa,

valuation.pb_ratio

).filter(

# valuation.pe_ratio > 0,

# indicator.inc_net_profit_year_on_year > 0,

# valuation.pe_ratio / indicator.inc_net_profit_year_on_year<1,

# valuation.pb_ratio < 3,

# indicator.roe / valuation.pb_ratio > 3.2, #国债收益率

indicator.roe > 0.15,

indicator.roa > 0.10,

valuation.code.in_(stocks))

df_fundamentals = get_fundamentals(q, date = None)

stocks = list(df_fundamentals.code)

# fuandamental data

df = get_fundamentals(query(valuation.code).filter(valuation.code.in_(stocks)).order_by(valuation.market_cap.asc()))

choice = list(df.code)

return choice

#1-1 根据最近一年分红除以当前总市值计算股息率并筛选排序

def get_dividend_ratio_filter_list(context, stock_list, sort, p1, p2):

time1 = context.previous_date

time0 = time1 - datetime.timedelta(days=365)

#获取分红数据,由于finance.run_query最多返回4000行,以防未来数据超限,最好把stock_list拆分后查询再组合

interval = 1000 #某只股票可能一年内多次分红,导致其所占行数大于1,所以interval不要取满4000

list_len = len(stock_list)

#截取不超过interval的列表并查询

q = query(

finance.STK_XR_XD.code,

finance.STK_XR_XD.a_registration_date,

finance.STK_XR_XD.bonus_amount_rmb

).filter(

finance.STK_XR_XD.a_registration_date >= time0,

finance.STK_XR_XD.a_registration_date <= time1,

finance.STK_XR_XD.code.in_(stock_list[:min(list_len, interval)]))

df = finance.run_query(q)

#对interval的部分分别查询并拼接

if list_len > interval:

df_num = list_len // interval

for i in range(df_num):

q = query(

finance.STK_XR_XD.code,

finance.STK_XR_XD.a_registration_date,

finance.STK_XR_XD.bonus_amount_rmb

).filter(

finance.STK_XR_XD.a_registration_date >= time0,

finance.STK_XR_XD.a_registration_date <= time1,

finance.STK_XR_XD.code.in_(stock_list[interval*(i+1):min(list_len,interval*(i+2))]))

temp_df = finance.run_query(q)

df = df.append(temp_df)

dividend = df.fillna(0)

dividend = dividend.set_index('code')

dividend = dividend.groupby('code').sum()

temp_list = list(dividend.index) #query查询不到无分红信息的股票,所以temp_list长度会小于stock_list

#获取市值相关数据

q = query(valuation.code,valuation.market_cap).filter(valuation.code.in_(temp_list))

cap = get_fundamentals(q, date=time1)

cap = cap.set_index('code')

#计算股息率

DR = pd.concat([dividend, cap] ,axis=1, sort=False)

DR['dividend_ratio'] = (DR['bonus_amount_rmb']/10000) / DR['market_cap']

#排序并筛选

DR = DR.sort_values(by=['dividend_ratio'], ascending=sort)

final_list = list(DR.index)[int(p1*len(DR)):int(p2*len(DR))]

return final_list

# 准备昨日涨停且正在持有的股票列表

def prepare_high_limit_list(context):

# 昨日涨停列表

g.high_limit_list = []

#获取已持有列表

hold_list = list(context.portfolio.positions)

if hold_list:

df = get_price(hold_list, end_date=context.previous_date, frequency='daily',

fields=['close', 'high_limit'],

count=1, panel=False)

g.high_limit_list = df[df['close'] == df['high_limit']]['code'].tolist()

#判断今天是否为账户资金再平衡的日期,空仓期一个月

g.no_trading_today_signal = False

# g.no_trading_today_signal = today_is_between(context, '04-01', '04-30')

#获取已持有列表

g.hold_list= []

for position in list(context.portfolio.positions.values()):

stock = position.security

g.hold_list.append(stock)

#获取最近一段时间持有过的股票列表

g.history_hold_list.append(g.hold_list)

if len(g.history_hold_list) >= g.limit_days:

g.history_hold_list = g.history_hold_list[-g.limit_days:]

temp_set = set()

for hold_list in g.history_hold_list:

for stock in hold_list:

temp_set.add(stock)

g.not_buy_again_list = list(temp_set)

# 调整昨日涨停股票

def check_limit_up(context):

if g.no_trading_today_signal == False:

# 获取持仓的昨日涨停列表

current_data = get_current_data()

if g.high_limit_list:

for stock in g.high_limit_list:

# 涨停的票,涨不动了就卖掉

if current_data[stock].last_price < current_data[stock].high_limit:

order_target(stock, 0)

log.info("[%s]涨停打开,卖出" % stock)

# just_sold标记本月涨停过的

g.just_sold.append(stock)

if len(g.just_sold) >= g.limit_days:

g.just_sold = g.just_sold[-g.stock_num:]

else:

log.info("[%s]涨停,继续持有" % stock)

position_count = len(context.portfolio.positions)

# 当持有股票数量不足时:

if g.stock_num > position_count and position_count != 0: # position_count != 0 用于避免第一次运行时代替go_trader 买入

my_Trader(context) # 每月的选股逻辑,计算 g.choice

cdata = get_current_data()

psize = context.portfolio.available_cash/(g.stock_num - position_count)

for s in g.choice:

if s not in context.portfolio.positions:

order = order_value(s, psize)

if len(context.portfolio.positions) == g.stock_num:

break

# 过滤科创北交股票

def filter_kcbj_stock(stock_list):

for stock in stock_list[:]:

if stock[0] == '4' or stock[0] == '8' or stock[:2] == '68':

stock_list.remove(stock)

return stock_list

# 过滤停牌股票

def filter_paused_stock(stock_list):

current_data = get_current_data()

return [stock for stock in stock_list if not current_data[stock].paused]

# 过滤ST及其他具有退市标签的股票

def filter_st_stock(stock_list):

current_data = get_current_data()

return [stock for stock in stock_list

if not current_data[stock].is_st

and 'ST' not in current_data[stock].name

and '*' not in current_data[stock].name

and '退' not in current_data[stock].name]

#2-6 过滤次新股

def filter_new_stock(context,stock_list):

yesterday = context.previous_date

return [stock for stock in stock_list if not yesterday - get_security_info(stock).start_date < datetime.timedelta(days=250)]

# 过滤涨幅过大的股票

def filter_limitup_stock(context, stock_list):

last_prices = history(1, unit='1m', field='close', security_list=stock_list)

current_data = get_current_data()

return [stock for stock in stock_list if stock in context.portfolio.positions.keys()

or last_prices[stock][-1] < current_data[stock].high_limit*0.97]

# 过滤跌幅过大的股票

def filter_limitdown_stock(context, stock_list):

last_prices = history(1, unit='1m', field='close', security_list=stock_list)

current_data = get_current_data()

return [stock for stock in stock_list if stock in context.portfolio.positions.keys()

or last_prices[stock][-1] > current_data[stock].low_limit*1.04]

#2-4 过滤股价高于10元的股票

def filter_highprice_stock(context,stock_list):

last_prices = history(1, unit='1m', field='close', security_list=stock_list)

return [stock for stock in stock_list if stock in context.portfolio.positions.keys()

or last_prices[stock][-1] < 10]

def after_market_close(context):

log.info(str(context.current_dt))

#4-2 如果no_trading_today_signal为True,则清仓

def close_account(context):

if g.no_trading_today_signal == True:

position_count = context.portfolio.positions

if len(position_count) != 0:

for stock in position_count:

position = context.portfolio.positions[stock]

close_position(position)

log.info("卖出[%s]" % (stock))

#3-1 交易模块-自定义下单

def order_target_value_(security, value):

if value == 0:

log.debug("Selling out %s" % (security))

else:

log.debug("Order %s to value %f" % (security, value))

return order_target_value(security, value)

#3-2 交易模块-开仓

def open_position(security, value):

order = order_target_value_(security, value)

if order != None and order.filled > 0:

return True

return False

#3-3 交易模块-平仓

def close_position(position):

security = position.security

order = order_target_value_(security, 0) # 可能会因停牌失败

if order != None:

if order.status == OrderStatus.held and order.filled == order.amount:

return True

return False

#4-1 判断今天是否为账户资金再平衡的日期

def today_is_between(context, start_date, end_date):

today = context.current_dt.strftime('%m-%d')

if (start_date <= today) and (today <= end_date):

return True

else:

return False

# end更多推荐

已为社区贡献4条内容

已为社区贡献4条内容

所有评论(0)