红杉投资对于 AI 未来投资的判断,与五个投资方向

英伟达早期开发的世界模型项目(如Google Earth)展示了AI在构建数字世界方面的潜力。红杉资本认为AI革命将带来10万亿美元的市场机遇,关键投资方向包括:持久记忆技术、AI通信协议、语音交互、安全防护和开源生态。当前AI正以远超工业革命的速度发展,推动服务行业从"确定性"向"1000倍杠杆效率"转变。视频分析了5大技术趋势和投资主题,指出算力正成为新

视频链接

https://www.youtube.com/watch?v=yoycgOMq1tI

世界模型,这是英伟达很早很早就开始的项目。

当年的 Google earth 就是英伟达世界模型的产物。

投资方向

长久记忆。

目前没有成熟的技术与解决方案 。

类似 TCP/IP 一样的通讯协议;

组织不同 AI 之间的对话。

AI 语音,就在现在发生;

是已经能够商用的 AI 应用。

AI 视觉不然需要时间,现在不成熟。 Apple 公司更新了其视觉大模型 FastVLM-CSDN博客

AI 安全

开源 AI 项目

54,511 views Aug 28, 2025

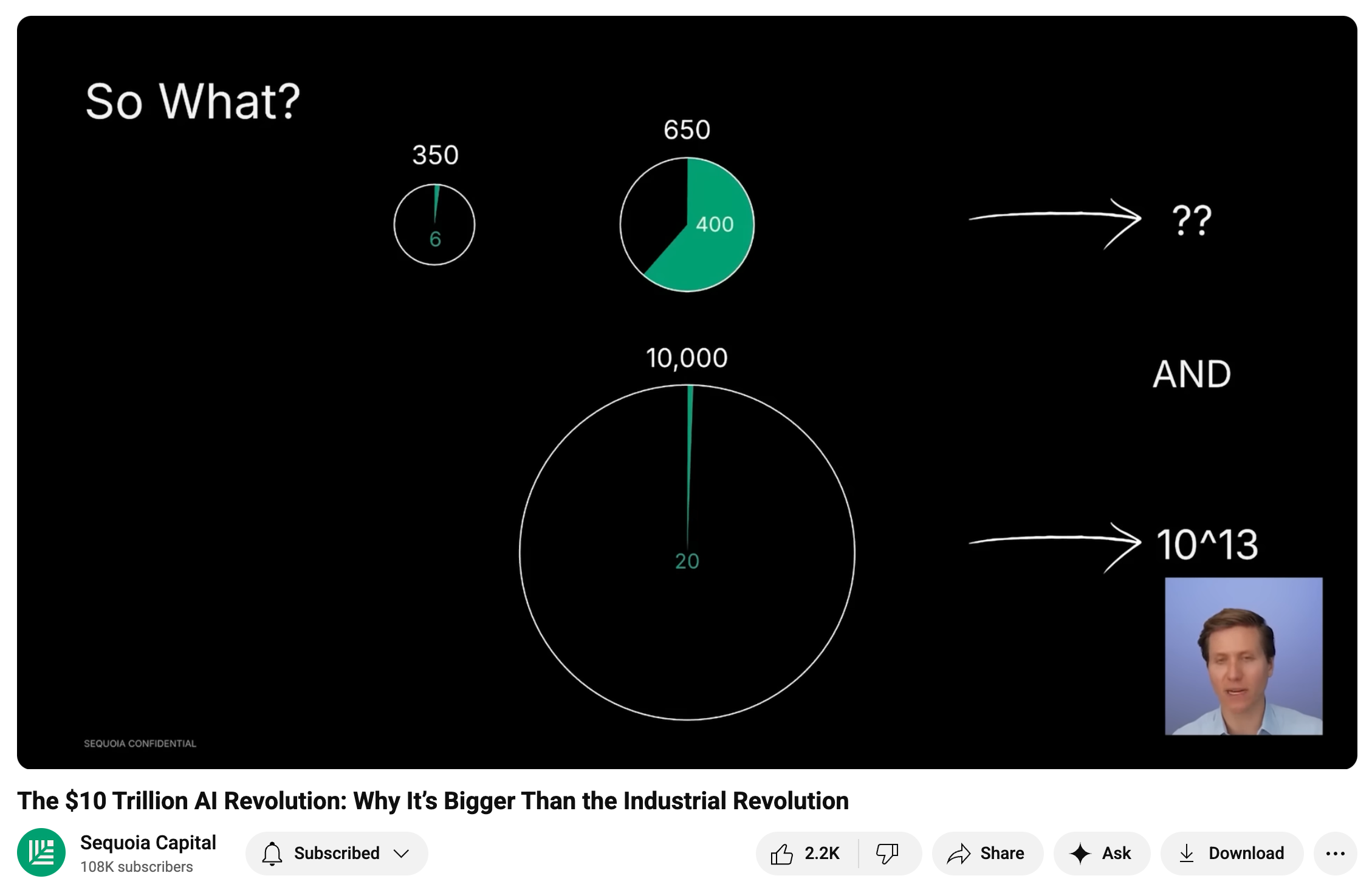

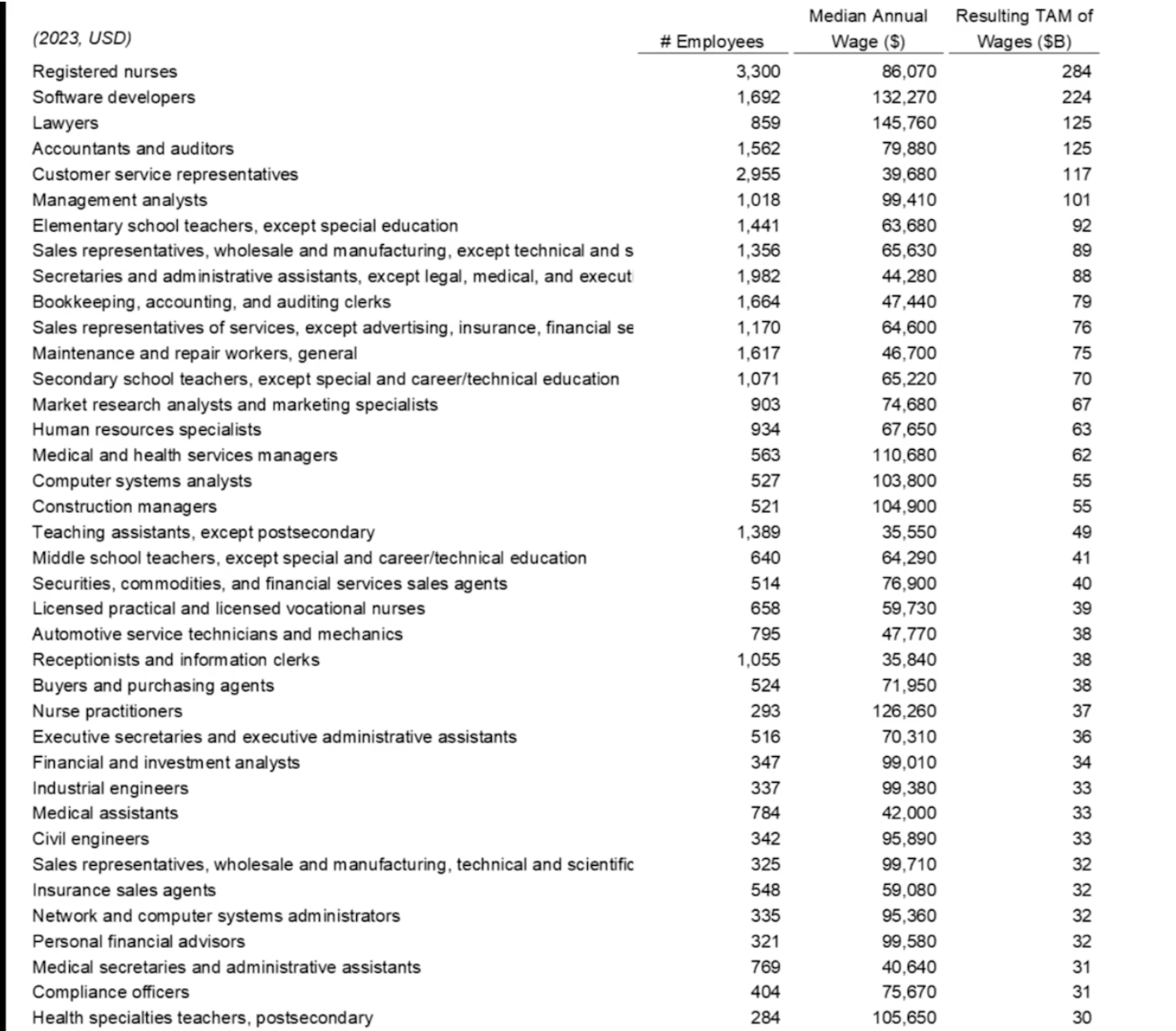

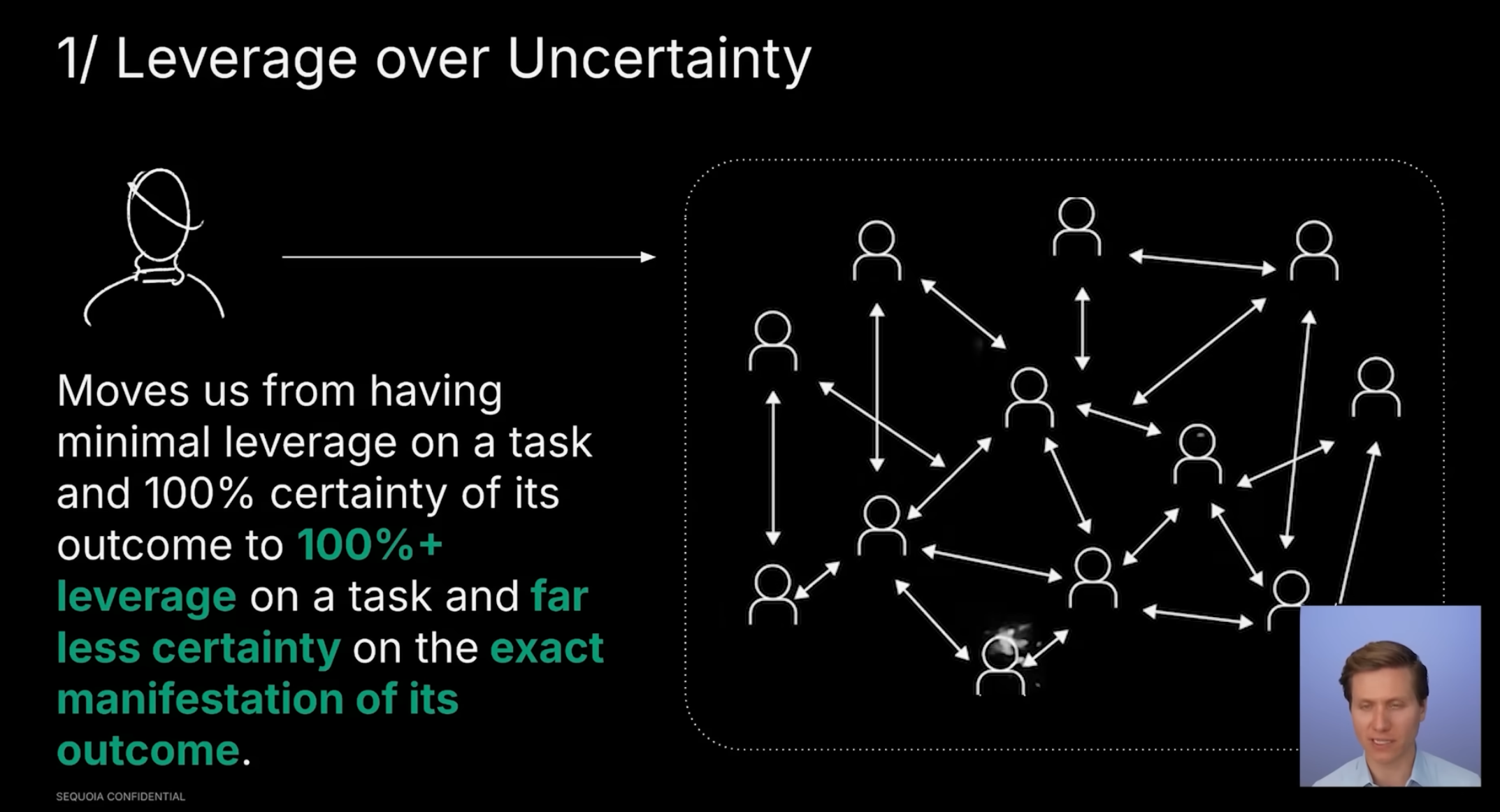

The cognitive revolution is here—and it's moving faster than the Industrial Revolution. In this presentation, Sequoia Capital's Konstantine Buhler shares an investment thesis on artificial intelligence and why we believe this transformation represents a $10 trillion opportunity. WHAT YOU'LL LEARN: 🏭 Why AI is like the Industrial Revolution, but compressed from 144 years to just a few 💰 The $10 trillion US services market that's only 0.2% automated by AI ⚖️ How work is shifting from "100% certainty" to "1000x leverage" ⚡ Why "FLOPs per knowledge worker" is the new production function 📊 How to think about market sizing in the AI era 🔧 The technical challenges that represent massive opportunities 🏆 Why academic AI benchmarks are dead (and what matters instead) 📈 The 5 investment trends happening right now 🎲 The 5 investment themes we're betting on next

00:00 - Introduction: The Cognitive Revolution

01:34 - Why AI = Industrial Revolution 2.0

02:39 - The $10 Trillion Services Opportunity

05:13 - Investment Trend #1: Leverage Over Uncertainty

06:38 - Investment Trend #2: Real-World Validation

07:31 - Investment Trend #3: Reinforcement Learning

07:56 - Investment Trend #4: AI in the Physical World

08:23 - Investment Trend #5: Compute as Production Function

------ 投资的方向 ------

9:15 - Investment Theme #1: Persistent Memory

10:10 - Investment Theme #2: Communication Protocols

11:09 - Investment Theme #3: AI Voice

12:23 - Investment Theme #4: AI Security

13:44 - Investment Theme #5: Open Source AI

14:31 - Conclusion: Compressing the Timeline

更多推荐

已为社区贡献19条内容

已为社区贡献19条内容

所有评论(0)